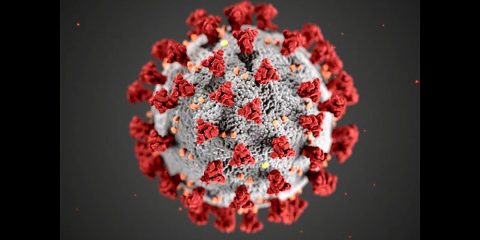

Northbrook, IL – As the coronavirus (COVID-19) pandemic impacts people and businesses across the country, both unemployment and the demand for delivery drivers are on the rise. Many businesses, especially restaurants, are relying on income from delivery services as most people stay home.

Northbrook, IL – As the coronavirus (COVID-19) pandemic impacts people and businesses across the country, both unemployment and the demand for delivery drivers are on the rise. Many businesses, especially restaurants, are relying on income from delivery services as most people stay home.

Allstate is taking action on both fronts to protect customers and employees from life’s uncertainties during these unprecedented times.

Starting this week and throughout the coronavirus (COVID-19) state of emergency, Allstate will automatically cover customers who use their personal vehicles to deliver food, medicine and other goods for a commercial purpose. Standard personal auto policies typically exclude such coverage.

This change will allow customers to serve those who depend on their services and support.

Allstate has also taken other actions to provide peace of mind to customers and to employees.

Allstate Customer Payment Relief and Virtual Auto Claims Process

Last week, Allstate announced a special payment plan to provide customers financial relief. The plan gives auto and homeowners policyholders the choice to delay two consecutive premium payments with no penalty.

Customers can also choose to pay what they can afford, with no minimum payment required. The total unpaid balance will be spread across the remaining bills. Customers can ask for this through their agent or by calling 1.800.ALLSTATE.

Allstate also makes it easy for auto customers to file a claim and get back on the road. Allstate is the only insurance carrier with Virtual Assist, which allows a body shop to create an initial estimate and get approval on supplemental coverage as they repair a vehicle.

Customers can submit their initial claim using QuickFoto Claim®, available through the Allstate Mobile app. Once everything is settled, Allstate can send payments instantly with QuickCard Pay – one of the fastest methods in the industry. Within the next week, Allstate anticipates that more than 90% of all auto claims will use these virtual tools, up from about 50% just two weeks ago.

In addition, Allstate is pausing policy non-renewals due to nonpayment during this crisis, including Allstate Business Insurance policies.

Allstate Supports Employees with Remote Work Policy, Compensation and Well-Being Services

Ninety percent of Allstate’s global workforce is working remotely. Allstate will continue to pay employees (full or part time) who can’t work remotely and have shelter-in-place orders during their normal work hours. Additionally, well-being services like telemedicine, prescription home delivery, and emotional and financial support lines are available to Allstate’s U.S. employees.